- The Beluga Brief

- Posts

- 🐳 Daily Edition: Bitcoin Takes a Plunge As Strategy Avoids Nasdaq Axe

🐳 Daily Edition: Bitcoin Takes a Plunge As Strategy Avoids Nasdaq Axe

BTC and ETH ETFs see major outflows over the last month while XRP ETFs attracted a fresh $1B in capital, could we see the same happen with other altcoin ETFs?

While MSCI’s decision remains pending, Michael Saylor’s Strategy dodged one major bullet on Friday in retaining its spot on the Nasdaq-100 index as removal could have led to $1.6B in potential forced selling. This indicates Nasdaq seems to be prioritizing market cap over company structure, which we can only hope MSCI follows suit in doing the same as removal could trigger an estimated $2.8B in forced selling. Saylor is seemingly unfazed by the turmoil, however, as they announced the acquisition of another $1B in BTC over the last week bringing their total holdings to 671k BTC, about 3.1% of the total supply.

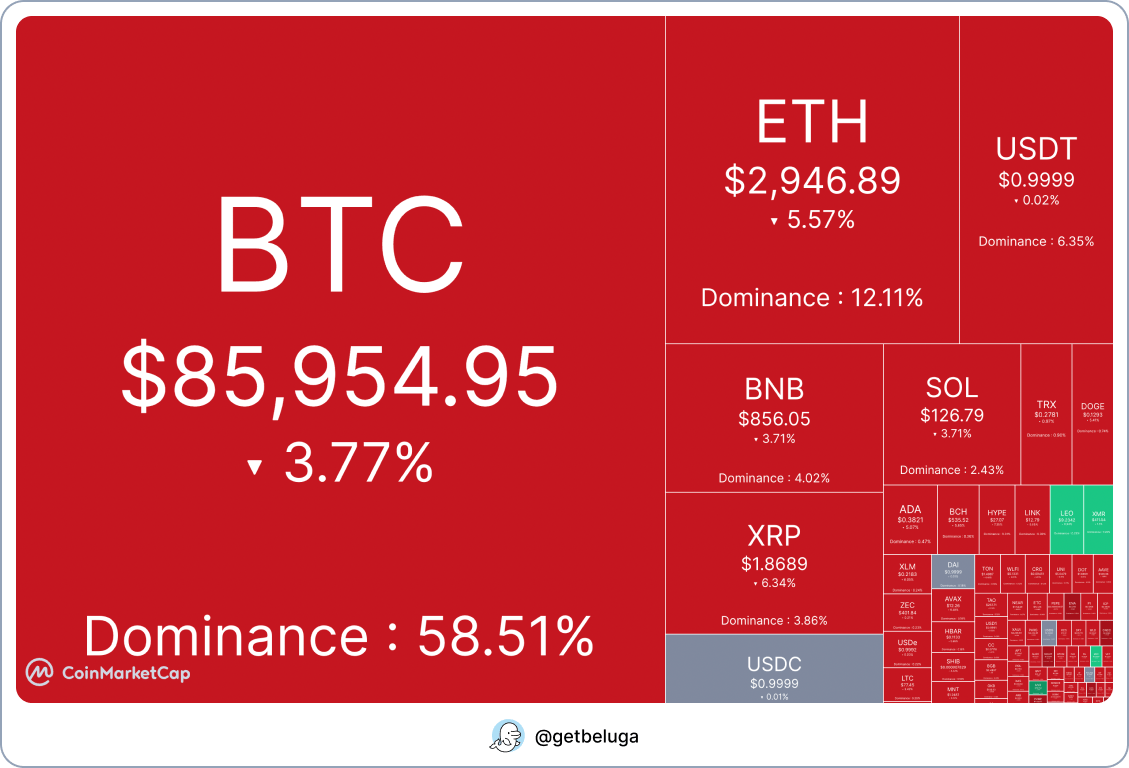

24 Hour Heatmap, Source: CoinMarketCap

Interestingly while Bitcoin and Ethereum ETFs have posted major outflows over the last month to the tune of ~$4.6B, the XRP ETFs recorded net inflows every day since their Nov 13th launch officially reaching $1B in cumulative net flows. I’m the first to admit that I am nowhere near an XRP bull (and in fact I’m pretty firmly on the bear side), but wow are those numbers impressive given Bitcoin has fallen 15% over that same time frame. XRP has long been an enigma to most crypto natives who view their purported adoption claims to be fake or misrepresented, yet that never seemed to matter to the XRP army. To paraphrase Dazed and Confused, the crypto market keeps getting older, but XRP holders stay the same.

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

New Launches

Interesting Reads

Check out our new articles below!

Toku is an excellent choice for crypto-native companies looking to offer the perk of getting paid in crypto. You can even pay international employees, contractors, and vendors directly in tokens. Offering seamless integration with traditional payroll providers like Workday and Gusto as well as instant settlement in USDC, Paxos USDG, and Ripple USD.*

Refer one subscriber to the Beluga Brief to receive two institutional-grade reports on AI powerhouses Near Protocol and Virtuals Protocol!