- The Beluga Brief

- Posts

- 🐳 Weekly Edition: Too Much Turkey Puts Market to Sleep

🐳 Weekly Edition: Too Much Turkey Puts Market to Sleep

Finally a slow stabilization period after a few weeks of violent red, meanwhile crypto scammers from the US are on the rise

First of all, Happy Thanksgiving to all Beluga Brief subscribers! If you were worried you might miss some major happenings in the crypto market while you took time off to eat turkey, you’ll be pleased to hear all is quiet on the crypto front. With the US stock market closed yesterday in addition to its early close today, volume across the board is quite low with Bitcoin looking to close the week above the $90k mark. Importantly, while volumes were admittedly muted, we did finally break the streak of major outflows from Bitcoin and Ethereum ETFs with nearly $70B in net flows since their launch. Doing their part to flip flows positive, Texas became the first US state to purchase Bitcoin for its Strategic Reserve with an $10M allocation. This amount doesn’t really move the needle for Texas (the 8th largest economy in the world), however this is an important first step to unlocking municipal and eventually federal capital to buy Bitcoin. We’re in a highly reflexive market, and once one domino falls we tend to see the rest follow suit.

Image generated via Grok

Especially with Texas now hopping on board it’s no secret the US has made major strides towards bringing crypto into the mainstream this year. Of course this is a double-edged sword, as the care-free attitude from the current administration has bred a new generation of scammers and grifters who see no consequences for their actions. A recent study published by blockchain analytics firm Bubblemaps purports that over 50% of all bundled token launches they examined this year originated from teams based in the US. For those unfamiliar, bundling is a method of controlling the supply of a token without being obvious to someone looking, which later allows the team to liquidate their tokens on unsuspecting traders. For a guy who remembers every successful crypto company based in the US getting investigated by the SEC just for existing, it’s wild to see how things have changed. There is a lot of good that has come from mainstream adoption, and I’m not arguing it’s a bad thing… but I think I speak for most of us when I say we need a real market structure bill before things get out of hand.

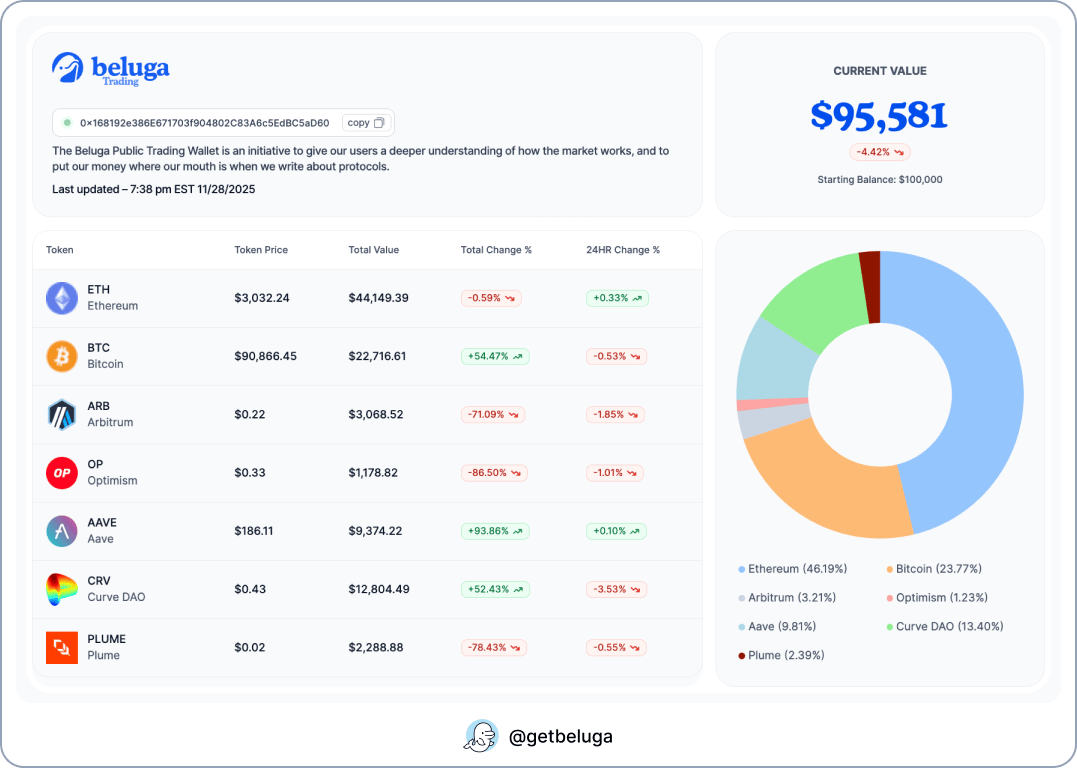

Tough few weeks for the Beluga portfolio pushing us down to $95k, which doesn’t come as much of a surprise given the sell off in ETH and BTC. What is surprising, however, is how rapidly our Plume holdings have started to slide in the last two weeks. Altcoins have certainly struggled this cycle but even I have to admit the PLUME chart is pretty brutal. For now the plan there stays the same, as I still believe they’re a leader in the RWA sector and tokenization is one of the clearest narratives I see for crypto in the mid to long term.

Despite all the bears coming out of hibernation, my views on crypto over the next few months haven’t changed much. Given how tightly Bitcoin is correlated to major tech stocks, and that it doesn’t look like the AI race is slowing down any time soon, even if you discount everything else we should expect to see green skies on the horizon.

Check out our new articles below!

Toku is an excellent choice for crypto-native companies looking to offer the perk of getting paid in crypto. You can even pay international employees, contractors, and vendors directly in tokens. Offering seamless integration with traditional payroll providers like Workday and Gusto as well as instant settlement in USDC, Paxos USDG, and Ripple USD.*