- The Beluga Brief

- Posts

- 🐳 Weekly Edition: Aave Conflict Resolves, Bitcoin Remains Stuck in Range

🐳 Weekly Edition: Aave Conflict Resolves, Bitcoin Remains Stuck in Range

Despite almost $24B of crypto options expiring today, we haven't seen the volatility we would typically expect from an event of that magnitude... it's almost like everyone is away for the holidays!

Want to know what Tom Lee’s price targets for Bitcoin and Ethereum in 2026 are? Refer a friend to the Beluga Brief to receive Fundstrat’s exclusive end of year report for free!

Running the risk of sounding like a broken record, Bitcoin looks to end the week at about $88k, still stuck in the same range we’ve seen for the last two weeks. Interestingly, today marked the largest options expiry in crypto history with $23.6B worth of contracts rolling off Deribit (the largest options exchange in crypto). The strike prices were concentrated between $85k, $90k and $100k, which could certainly have played a part in creating this aforementioned range. My opinion however is recent price action has mostly been driven by lower volumes (holiday season) and ETF flows flipping negative in December; this isn’t much of a stretch considering how vital the inflows we enjoyed for over a year have been to Bitcoin’s price appreciation.

Aave Founder Stani Kulechov, Source: DLNews

By way of an update for readers interested in the Aave shenanigans we discussed on Monday, the proposal that essentially constituted a hostile takeover of Aave Labs assets has failed decisively after Aave founder Stani Kulechov pushed it to vote before it was ready. This has been an incredibly interesting case to follow, as Aave was previously seen as one of the brightest success stories for DAOs. While I still believe this to be the case, I also think it’s important to recognize the shortcomings of a decentralized governance structure. There is certainly wisdom in the crowds, but that doesn’t mean the crowd will be good at developing a software company responsible for securing 10’s of billions of dollars. The Aave DAO has done an incredible job stewarding the brand and has undoubtedly been a major factor in getting the protocol to where it is today, but removing important revenue streams from Aave Labs and removing their incentive to keep improving the protocol is not the way forward.

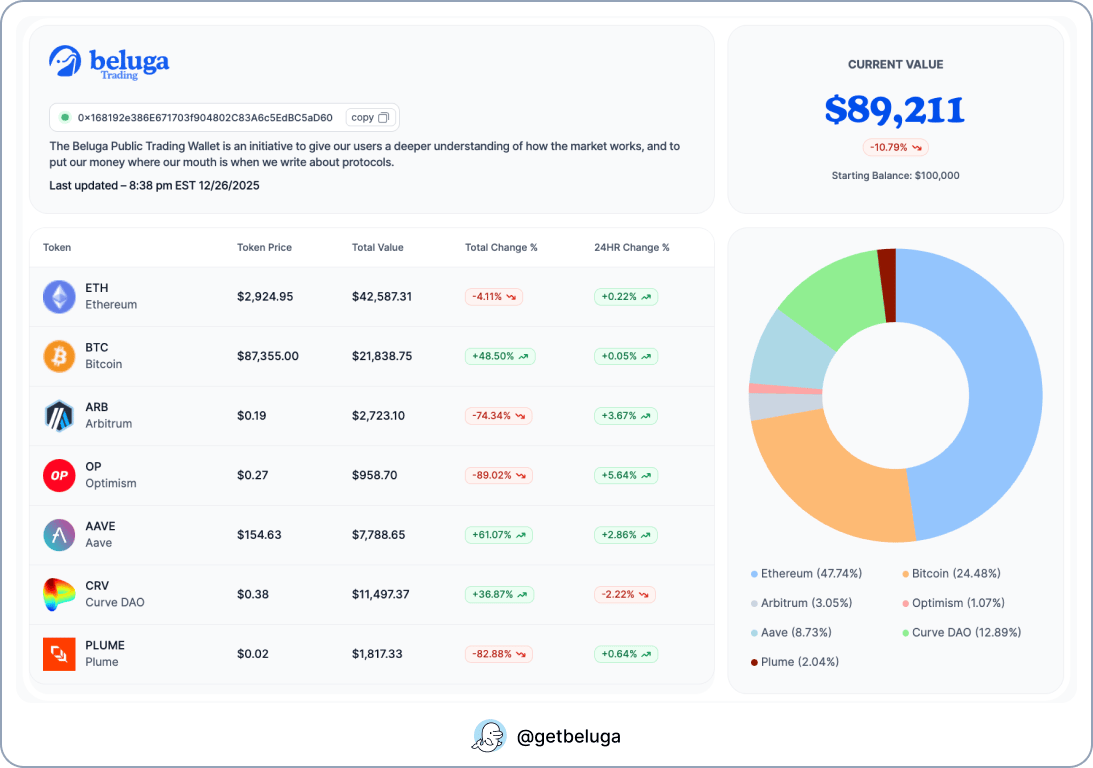

The Beluga wallet remains largely unchanged in valuation since last week, and I won’t be looking to make any moves while prices and sentiment remains this way. If we had active capital to deploy I might be singing a different tune, but given our positioning I think that’s the best strategy for the moment. As volumes begin to return in January, we’ll reassess!

Check out our new articles below!