- The Beluga Brief

- Posts

- 🐳 Daily Edition: Anonymous Whale Sweeps $10M of NFTs, Time for Opensea Airdrop?

🐳 Daily Edition: Anonymous Whale Sweeps $10M of NFTs, Time for Opensea Airdrop?

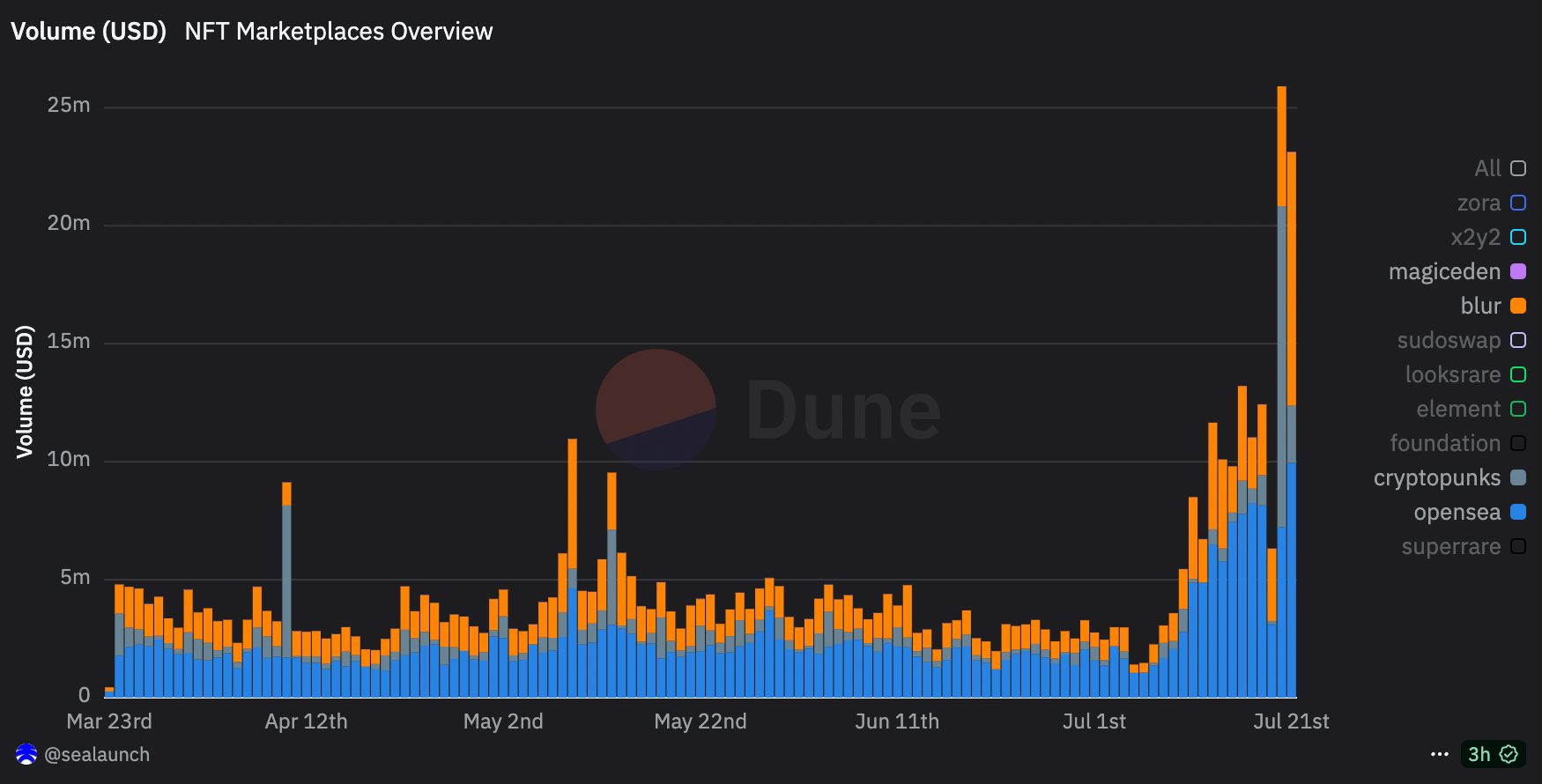

As Ethereum rapidly ascends towards the $4k mark, anonymous whales seem to be funneling profits into NFTs with marketplace volume rising +300% in a week.

I’m going to say something you probably haven’t heard in a while: NFTs might be back. This past weekend, an anonymous wallet purchased 45 CryptoPunks in one go totaling over $10M in purchases, prompting all heads to turn back to our favorite non-fungible assets. For anyone who doesn’t know, CryptoPunks are widely considered to be the only “bluechip” NFT with a number of record-breaking sales over $10M for individual NFTs in 2021 and 2022. Because of this status, they also tend to be looked at as a leading-indicator for where the NFT market might be heading next — if the price action of this weekend is any clue, it just might be going higher.

Notably, this is the first time to my memory that we’ve seen an anonymous wallet with significant capital sweep a collection since the peak of NFT market days… as the data shows OpenSea has been the largest recipient of the resurgence in NFT volume (not counting the CryptoPunks volume, as they are incompatible with all marketplaces but their own), could this be a sign OpenSea is finally gearing up for their token launch? From a market timing perspective these are the best conditions for a TGE in years, and if this really is the start of an NFT run they might be able to sustain a reasonably high valuation too.

On the fungible side of the market, Bitcoin continues its sideways action holding around the $117-$120k range which has given altcoins some breathing room to reprice. While I won’t argue for the value of the vast majority of altcoins as the reality is many are probably worth 0, the weakness of the market led to many tokens representative of strong businesses to trade below their fair value. Most of these fall within the DeFi sector, including Aave, Curve and Sky (formerly MakerDAO) — all of which are up significantly in the last 2 weeks. According to data from DefiLlama, about 60% of all crypto TVL (a measurement of capital held within apps) is on Ethereum mainnet, and close to 70% if you include its L2 networks. In other words, Ethereum’s performance is inextricably linked to DeFi performance and I believe we’re just seeing the start of this move.

I’m sure it’s purely a coincidence that Saylor drew the graphic like that

You can't make this shit up 😂😂

Bro used a literal Pyramid to illustrate MSTR

I guess you can call it a scheme of sorts, a pyramid scheme, if you will

— Wazz (@WazzCrypto)

9:16 PM • Jul 21, 2025

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

Apps

Random

Beluga is excited to offer a brand new Starter Pack with our partners at Sapien, a gamified data-labeling protocol built to service the future of enterprise AI.