- The Beluga Brief

- Posts

- 🐳 Daily Edition: December Opens Red, Michael Saylor is Selling?

🐳 Daily Edition: December Opens Red, Michael Saylor is Selling?

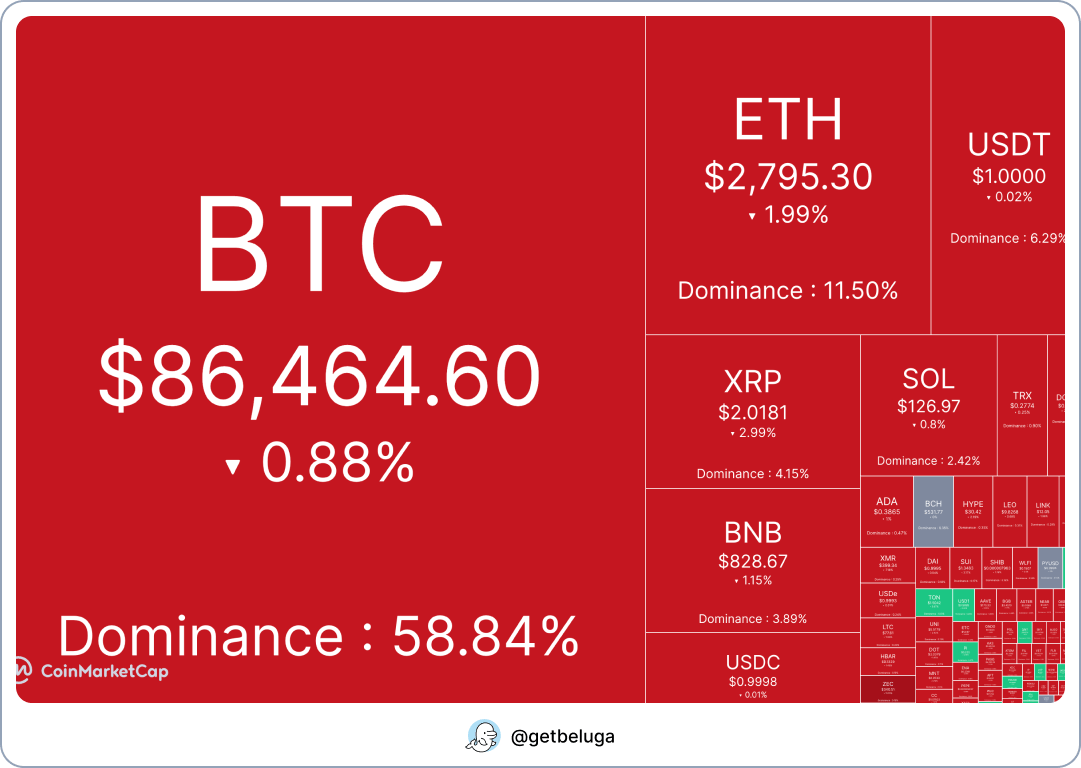

Weak performance on Bitcoin sparks market fear as Saylor discusses selling for the first time

Just as November turned to December late last night, Bitcoin experienced a rapid selloff taking it from over $91k to under $84k, prompting over a half a billion in liquidations and further fear among traders. When Bitcoin was still trading over $110k just a few weeks ago, we flagged a few Digital Asset Treasury (DAT) companies that had begun dipping under mNAV, leading some to offload crypto in favor of buying back shares. On paper this is an obvious move, but in effect it has a real effect on the psyche of retail investors potentially causing a self-fulfilling loop to the downside. In simple terms, people see large DATs selling, people decide to sell themselves, DATs have to sell increasingly high amounts until there is none left. While it’s been around much longer than the rest, Michael Saylor’s Strategy is the largest DAT in the game… and they’re now sitting just barely above their mNAV after its stock has dropped over 60% since July. I will say that FUD around Michael Saylor typically marks a bottom, but even I have to take note that today’s Strategy call marked the first time Michael Saylor has even mentioned selling their BTC to my memory.

24 Hour Heatmap, Source: CoinMarketCap

One interesting trope of the crypto market to pay attention to is how even bastions of the industry receive FUD when prices are down. For example, take a look at this recent clip from legendary trader Arthur Hayes where he explains why Solana can’t beat Ethereum. It may be true that most of Solana’s price appreciation this cycle was due to memecoin activity, but that’s also far from a new realization. Just a few months ago, that exact rationale would have actually been treated as bullish; now, people say they have to find a new “trick” or they’ll go to 0. Regardless of my own views on the subject, I point this out to urge our readers to be careful believing everything they see online, even when its from “experts” like Arthur Hayes. Price often dictates the lens which people view the market with and so especially in times like this, it’s important to take in information and draw your own conclusions. Just because prices are down, doesn’t mean all your favorite coins are bad.

What part of the cycle are we at when our favorite blockchain investigator starts speaking Pidgin?

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

New Launches

Interesting Reads

Crypto Conference Circuit

Check out our new articles below!

Toku is an excellent choice for crypto-native companies looking to offer the perk of getting paid in crypto. You can even pay international employees, contractors, and vendors directly in tokens. Offering seamless integration with traditional payroll providers like Workday and Gusto as well as instant settlement in USDC, Paxos USDG, and Ripple USD.*