- The Beluga Brief

- Posts

- 🐳 Weekly Edition: $120k for one Bitcoin?!

🐳 Weekly Edition: $120k for one Bitcoin?!

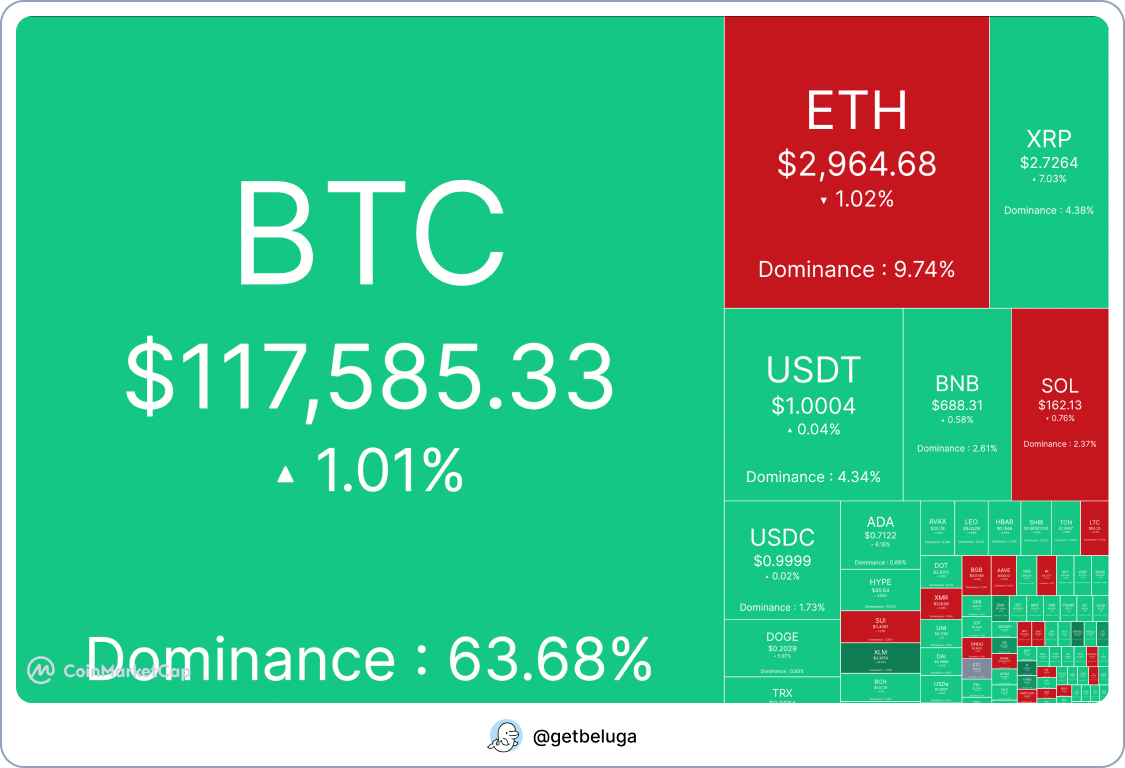

Bitcoin smashes a new ATH as Ethereum breaks $3k again, is it finally time for alt season?

If you somehow missed it, yesterday Bitcoin shattered its previous all-time high and touched just under $120k earlier today. While it’s certainly not at a new ATH, Ethereum’s performance this week has been similarly impressive, rising 20% over the last week to reach $3k once again and it doesn’t look to be stopping here. We’re also finally seeing significant flows into the Ethereum ETF’s with Blackrock’s ETHA taking in a record $300M today. Asset tokenization always made the most sense to be done on Ethereum, and it seems the market is coming to its senses there. The asset tokenization market is projected to reach over $15 trillion by 2030, roughly a 50x from where it currently is — if the ETH tokenization thesis continues to play out like we think it will, we are in for quite a ride.

It also seems that pump.fun has timed its TGE quite well, with the presale set to go live tomorrow on a number of top exchanges as the entire market pumps. As we mentioned earlier in the week, their $1B total raise would make it the second largest raise in crypto of all time. The fact they should be able to fill this with no problem indicates the level of liquidity still lying around in this market. Despite prices dropping significantly from January to April, it seems most of the liquidity actually just stuck around as stablecoins rather than getting offramped. When you have so much capital sitting onchain, all you need to set off a major run is a single catalyst… could that be pump.fun and its airdrop? We’ll find out soon.

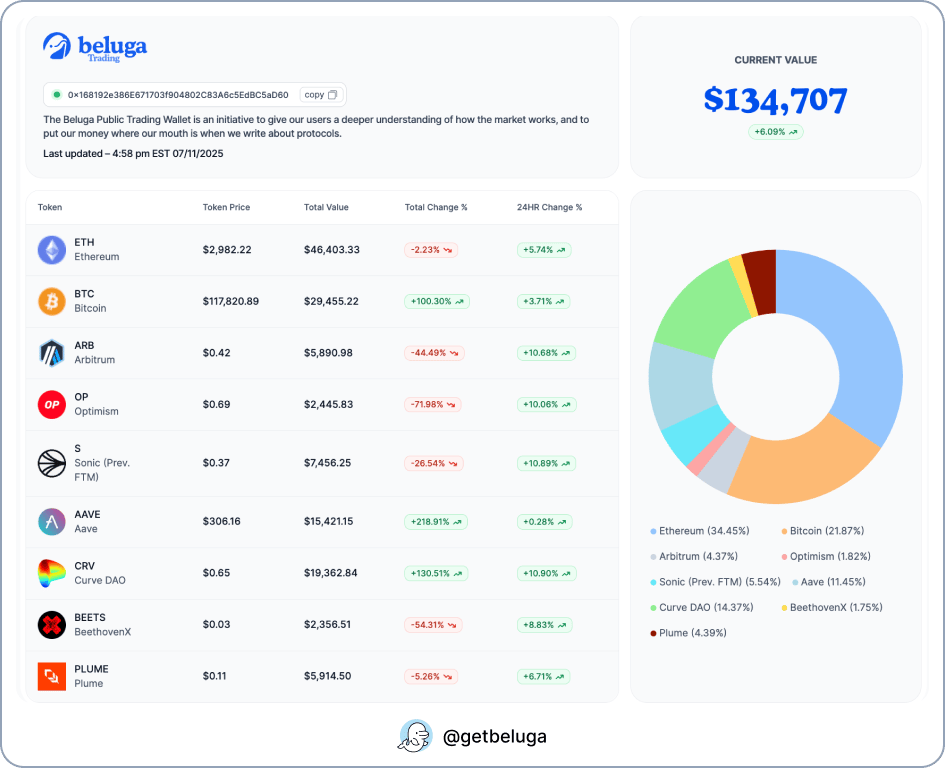

Well the Beluga Trading Wallet is as green as the market, with our portfolio up over 6% today alone as Bitcoin and Ethereum both rise significantly officially putting our BTC position up to 100% gain. With most of these tokens purchased last summer and fall, those are some pretty impressive returns. I also think we’re really well positioned to capture most of the upside of a stablecoin x tokenization bull run between our ETH, AAVE, CRV and PLUME holdings, and if it continues to be a Bitcoin cycle we of course have anchored the portfolio there. The wildcard here is whether the ETH narrative of tokenization will translate to Optimism (one of its L2’s) doing well, as it’s safe to say the market has not cared at all about L2’s for quite some time. Arbitrum is also an L2, however their recently-announced partnership with Robinhood along with HyperLiquid using it as a bridge means they’ll have a much easier time regaining attention and status.

Sonic and its eco has been pretty neglected since their launch, which has resulted in a significant drop off for both it and its flagship staking provider BEETS. Rather than cut these two positions, I think given their small allocation within the portfolio it’s worth holding on in case we see a major resurgence in DeFi. DeFi TVL has risen rapidly recently on Ethereum, and we could see that start to trickle into other ecosystems — I strongly believe Sonic has the most potential of any alt L1 for DeFi given its team, history and recent tech upgrade. If you notice outperformance within the DeFi sector, could be a good idea to keep a closer eye on Sonic.

Transaction fees have plagued the crypto industry for years, but finally Gas.Network is here to tackle the $1B gas efficiency problem. Check out their new article below and learn how to get started earning points 👀

How @gasdotnetwork's "Capture the Gap" Game Is Tackling The $1 Billion On-Chain Efficiency Problem

If you don’t get it yet… you will.

🧠 Dive in:

👉 hackernoon.com/how-gas-networ…— Beluga (@getbeluga)

7:47 PM • Jul 11, 2025