- The Beluga Brief

- Posts

- 🐳 Weekly Edition: Galaxy Digital Completes Largest BTC Sale of All Time, Prices Barely Move

🐳 Weekly Edition: Galaxy Digital Completes Largest BTC Sale of All Time, Prices Barely Move

BlackRock's Head of Digital Assets Announces Move to ETH Treasury Company SharpLink Digital as ETHA Hits $10B in AUM

Today officially marks the end of Galaxy Digital’s sale of 80,000 Bitcoins worth over $9 billion on behalf of a Satoshi-era wallet, suspected to be either the anonymous founder of now-defunct platform MyBitcoin or the group that hacked it back in 2011. While the seller remains in the shadows, what we do know is this is one of if not the largest dumps of BTC of all time, and all it did was move us from $120k to $117k. This is an incredible testament to the rising liquidity and sentiment in crypto, as when the German Government sold 50,000 BTC last summer, Bitcoin dropped over 20% to $55,000 (which also means they missed out on roughly $3.5B in profits at current prices).

Galaxy Digital CEO Mike Novogratz (Yes, it’s THAT Luna)

A big piece of this is of course the inflows from the Bitcoin and Ethereum ETFs, which both continue to break records. BlackRock’s ETHA Ethereum ETF has now reached $10B in AUM, the third fastest ETF of all time to reach that milestone at 251 days. This is an impressive achievement on its own, however $5B of that total $10B has been added since July 3 — in other words, demand for Ethereum is off the charts. In fact, BlackRock’s Head of Digital Assets announced his leave from the company today in order to pursue a co-CEO position at second-largest Ethereum treasury company SharpLink Gaming. I remain dubious of the longevity of these kinds of companies and believe they are the biggest ticking time-bomb in the industry at the moment, but this move signals major confidence in the model and I’m interested to see how “having an adult in the room” will change the structure of the business.

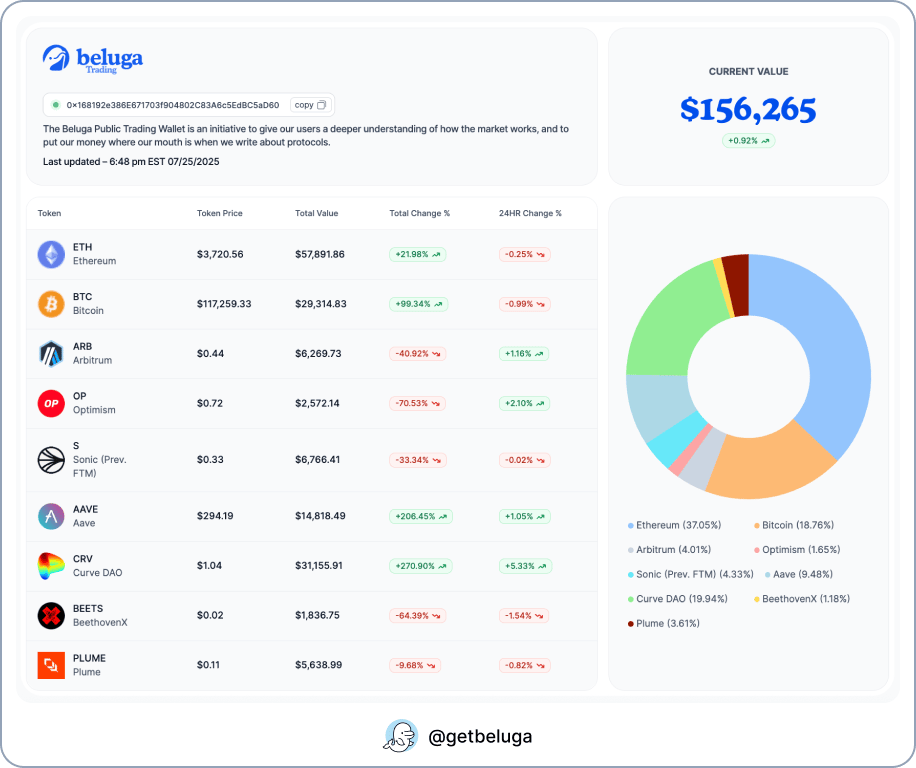

We’re sitting slightly up from last Friday’s update on the Public Trading Wallet (free for everyone to watch on the Beluga website) with no changes to our portfolio. These days I am getting lots of questions from either traders who have been sidelined or new entrants to the ecosystem about where to allocate their capital, so I thought it could be helpful to get into how we’re currently positioned and what my outlook on the market is. For long-time readers, you’ll know our portfolio has been heavily allocated to Ethereum and what we view as strong betas to ETH since we launched the wallet. Throughout the frankly abysmal price action earlier this year our thesis did not change, and we’re now starting to see the fruits of our labor. You might also notice, however, that these aren’t positions we’re increasing, and we actually haven’t made a new trade in quite some time.

My view is I’m happy with the narratives we’ve placed our bets in, with the only truly viable one we’re missing being AI. I don’t think the AI craze is going anywhere and seems to still be growing at an exponential rate, however the history of AI x Crypto projects is filled with vaporware or just straight up scams. I’m sure there are many great teams in our industry, but the reality is we can’t compete with companies like OpenAI or Meta with their multi-billion dollar warchests specifically for acquiring talent. The money for AI remains outside of crypto, and so I’d rather focus on other verticals like DeFi or RWA’s where we’re seeing exciting tech gain real adoption instead of buzzword-laden marketing schemes. In my 6 years trading digital assets, the most important lesson I’ve learned is that when I develop a thesis, I’m better off seeing it to fruition rather than chasing the next hot thing — too many good traders and investors follow the latter path and end up chopping up their portfolio to 0. For this reason I intend to sit in these bags until the time is right to rotate, which of course is always the hard part. Key indicators I’m looking for on the altcoin side would be outperformance of alts in light of weakness in Bitcoin, which is actually something we began to see this week.

It’s been a rough week for PUMP longers (myself included)

Me reading the PUMP tokenomics after being down 60% in a week.

— Steven (@Dogetoshi)

8:19 PM • Jul 24, 2025

Our world-class partners at Reflexivity Research have just released their deep-dive on FAIR, a new Layer 1 launch from the SKALE Labs team. Check it out at the link below, free for all Beluga readers!

MEV has quietly siphoned nearly $2 billion from crypto users through hidden transaction manipulation like front-running and sandwich attacks. FAIR, a new Layer-1 from the SKALE Labs team, tackles this head-on with encrypted consensus that neutralizes MEV at the protocol level.

Read the full report here!