- The Beluga Brief

- Posts

- 🐳 Daily Edition: Saylor Buys $2.1B in BTC, CLARITY Act Delayed 1-2 Months

🐳 Daily Edition: Saylor Buys $2.1B in BTC, CLARITY Act Delayed 1-2 Months

The crypto market was shaken by Trump's tariff threats over control of Greenland as DAT companies continue to gobble up BTC and ETH

Last week’s positive price action was no match for Trump’s tariff threats around Greenland this week as BTC dove from $95k Sunday night to $87k at its lowest point. Incredibly, Michael Saylor’s Strategy managed to top tick Bitcoin once again with a $2.1B purchase at a $95k average — as we’ve seen in the past with low liquidity periods, purchase behavior of that magnitude likely contributed quite a bit to the price of BTC rising. In other words, Michael Saylor was probably the main source of last week’s pump, and without that strong bid there wasn’t enough pressure to support prices against the tariff threats.

The conversation surrounding the Senate’s CLARITY Act continues with some sources reporting it may end up being delayed until the end of March amid a push from the Trump admin for housing legislation. This may end up being a blessing in disguise as most parties agreed the bill was half-baked and left a lot of room for potential threats to legitimate crypto businesses, so more time could allow them to make the right edits. Conversely, this also means adoption by major institutions is still impeded by the lack of a market structure bill: if they don’t know the rules, it’s hard to risk future liability just to expand their crypto activities.

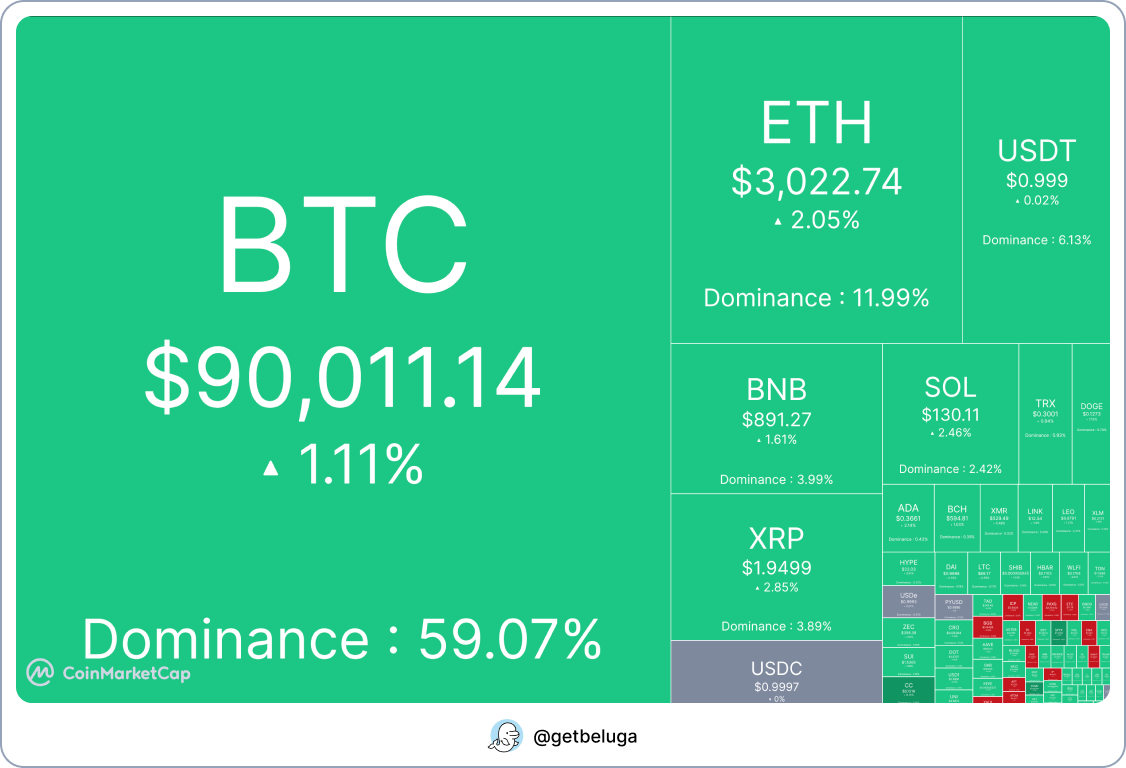

24 Hour Heatmap, Source: CoinMarketCap

An interesting trend to watch from the Ethereum ecosystem is how well it’s scaling since the last upgrade dubbed Fusaka, with TPS across mainnet and L2’s reaching an all-time high today despite gas fees staying at lows. And to think I was happy paying $100+ transaction fees just 3 years ago on transactions that would cost pennies today… the progress is truly impressive, especially given decentralization has been maintained throughout the process. Most other chains shooting for scalability have chosen to sacrifice their decentralization in order to process as many TPS as possible. To me this eliminates the value prop of using blockchain rails in the first place… if one entity controls the majority of validators in a given network, you may as well just be using TradFi.

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

New Launches

Interesting Reads

Native American tribes claim Kalshi prediction markets ‘siphon’ money from casinos

Check out our new articles below!