- The Beluga Brief

- Posts

- 🐳 Daily Edition: Crypto DATs Lose Their Premium, is the Infinite Bid Over?

🐳 Daily Edition: Crypto DATs Lose Their Premium, is the Infinite Bid Over?

Ethereum DAT ETHZilla has announced the start of a share buyback program in an effort to stop the bleed on their stock price, is the treasury trend over?

The Beluga Brief is officially back after a much needed break, here to deliver all the most important events and insights happening in crypto. A lot has happened in our absence, so let’s dive right into it! Markets have cooled off quite a bit since our last update, with Bitcoin currently fighting to hold the $112k mark and Ethereum dropping down to $4,300. As we discussed when ETH first started pulling off of it’s new ATH reached at the end of August, after a monster run up it’s healthy to see some consolidation.

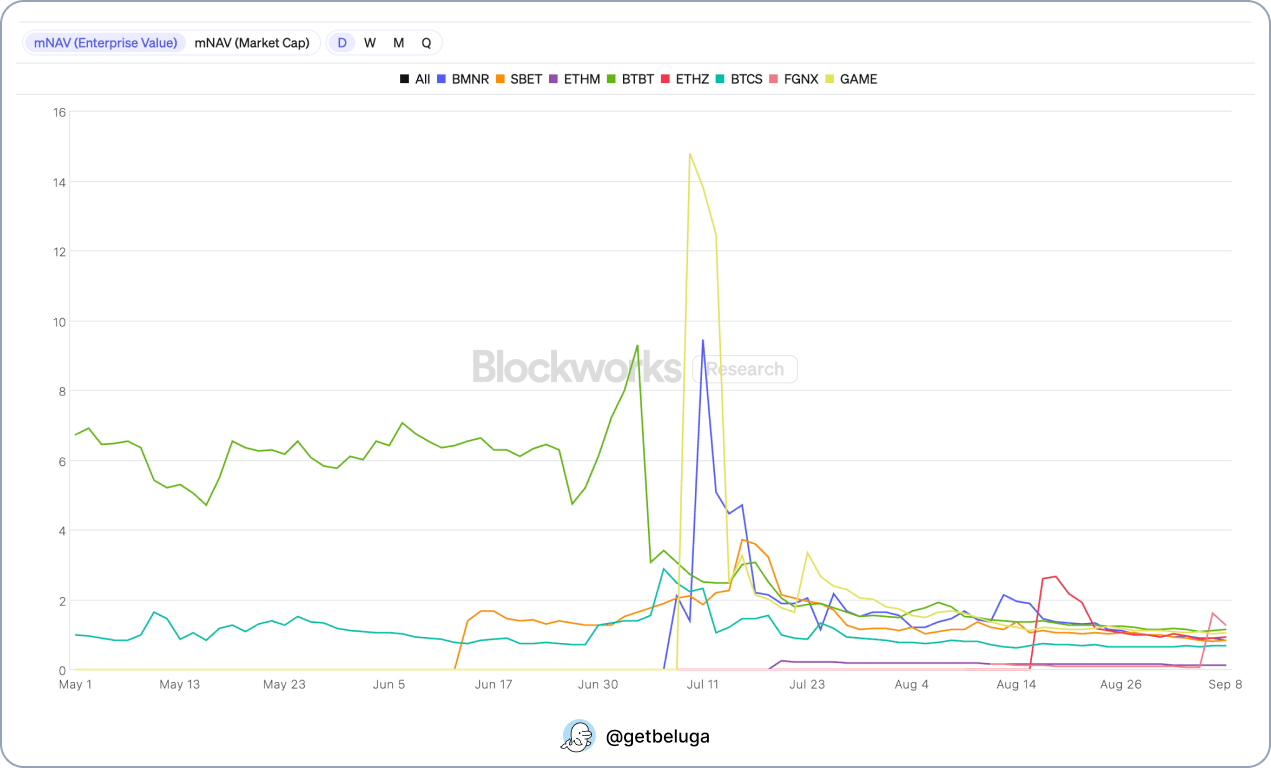

The DAT (Digital Asset Treasury) trend is still in full swing, slowly trickling down to higher-risk altcoins and away from majors Bitcoin and Ethereum. This trend away from majors may be a natural progression for these investment vehicles, however it’s likely also do to the rapidly-decreasing mNAV (Ratio of Market Cap to Native Asset Value) for the vast majority of these companies. Essentially, the way they function is by selling shares to the public at a premium to their crypto holdings, in order to then purchase more crypto and increase the amount of crypto held per share. If shares trade at a discount, however, this strategy stops working, as there is no premium for them to capture and fund more crypto purchases.

mNAV for Ethereum DATs, Source: Blockworks Research

As a direct result of this, we’ve already seen Ethereum DAT “ETHZilla” begin a share buyback program in an effort to raise their mNAV into the premium zone once again. This is really just a bandaid on a festering wound, however, and I expect to see most of these falling off the map at some point in the next several months. At the end of the day the only thing that separates them is brand value — Strategy (formerly MicroStrategy) is the only “successful” one so far, but that is due to the sheer size of their Bitcoin treasury, and the fact it would be nearly impossible for an entity to acquire that amount on the open market without paying a massive premium. We shouldn’t expect other DATs to reach this status simply because everyone knows their game already, they have no time to stealthily accumulate allá Michael Saylor.

To me these are a ticking time-bomb, and it’s good to see them cool off before they’ve acquired too much supply. They can provide immense short term liquidity, however they will eventually be forced to sell whether to take profit, to payback investors, or any number of reasons. ETFs still provide the main source of inflows for BTC and ETH, so losing the DAT bid is likely not as big a deal as many experts in the crypto community have made it out to be. I remain very bullish on crypto and don’t think we see the end of this run any time soon!

The big scare in the crypto world today involved the compromising of an NPM developer whose packages have billions of downloads every week. The hack had the potential to be truly catastrophic, yet the hackers managed to make less than $50. They should just get a job at McDonald’s, it would pay more.

Picture this: you compromise the account of a NPM developer whose packages are downloaded more than 2 billion times per week. You could have unfettered access to millions of developer workstations. Untold riches await you. The world is your oyster.

You profit less than 50 USD.

— Security Alliance (@_SEAL_Org)

7:58 PM • Sep 8, 2025

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

Regulatory

Prediction Markets

This week Beluga is featuring the ether.fi Cash program, the latest product addition to a leading DeFi protocol which has already amassed over $5B in TVL. The best part of ether.fi's offering is the ability to use the card as either a high-reward debit account or a credit account that lets you borrow against your balance without having to sell — it's like having Aave in your pocket where each swipe of your card creates a new lending position against your collateral. To learn more about the card, check out our full review here!