- The Beluga Brief

- Posts

- 🐳 Daily Edition: Blood in the Water as BTC Slides to $75k

🐳 Daily Edition: Blood in the Water as BTC Slides to $75k

Market volatility to the downside pushes over $2.5B in liquidations over the weekend, maybe we can move the leverage slider further to the left next time?

Needless to say this wasn’t a fun weekend for crypto bulls as Bitcoin dove back to $75k on Saturday, prompting about $2.3B in liquidations on futures traders in one of the bloodiest days in a long time. Of course this is just a small fraction of the whopping $19B on October 10th but these events add up quickly. The leverage in the market is just a continuation of a worrying trend we’ve seen for a while now; it’s my humble opinion that in a market as volatile as we have in crypto, adding leverage to the mix is both unnecessary and incredibly risky.

For some anecdotal evidence, 8 of the top traders on Hyperliquid last year (we’re talking $10’s if not $100’s of millions in profits) are now massively unprofitable. Even Garrett Bullish, the alleged insider trader who made tens of millions shorting the market just before Trump’s tariff announcements on October 10th, was liquidated for over $200M this weekend.

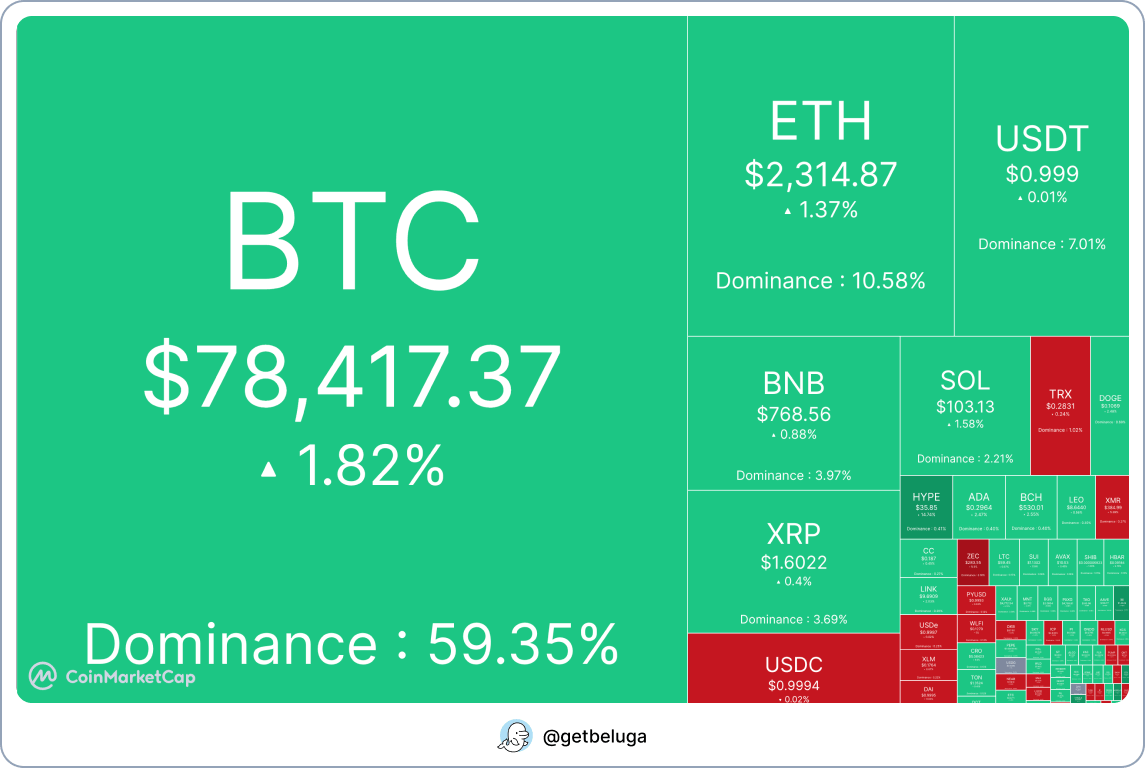

24 Hour Heatmap, Source: CoinMarketCap

Piling onto the negative news, Tom Lee’s Bitmine is now sitting at a (unrealized) loss of about $6.6B. The unfortunate truth is all DATs are in the same boat here, even MicroStrategy. Because of their funding mechanisms, they tend to only have liquidity to buy when prices are going up; as it became an arms race to accumulate faster than competitors, they were all forced to repeatedly top blast. In fact, the unrealized loss across all Ethereum DATs is now $8B, the same amount lost in the collapse of FTX.

This price action, no matter how brutal to experience, really hasn’t changed my views on where BTC and ETH are eventually going. We’re in unprecedented times on so many levels including macro pressures, political mayhem, liquidity constraints, and the rise of attention-grabbing industries like AI that it’s hard for crypto to maintain the spotlight. The golden days of every altcoin running no matter how stupid it is are likely gone, but that doesn’t mean we won’t see pockets of incredible success when we break through the noise.

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

New Launches

Interesting Reads

Check out our latest articles below!

What do these names have in common?

Arnold Schwarzenegger

Codie Sanchez

Scott Galloway

Colin & Samir

Shaan Puri

Jay Shetty

They all run their businesses on beehiiv. Newsletters, websites, digital products, and more. beehiiv is the only platform you need to take your content business to the next level.

🚨Limited time offer: Get 30% off your first 3 months on beehiiv. Just use code PLATFORM30 at checkout.