- The Beluga Brief

- Posts

- 🐳 Weekly Edition: Institutional Adoption Outpaces Estimates, Sets 2026 Up for Success

🐳 Weekly Edition: Institutional Adoption Outpaces Estimates, Sets 2026 Up for Success

It's easy to get lost in the price action and liquidations, but crypto made some major progress this year

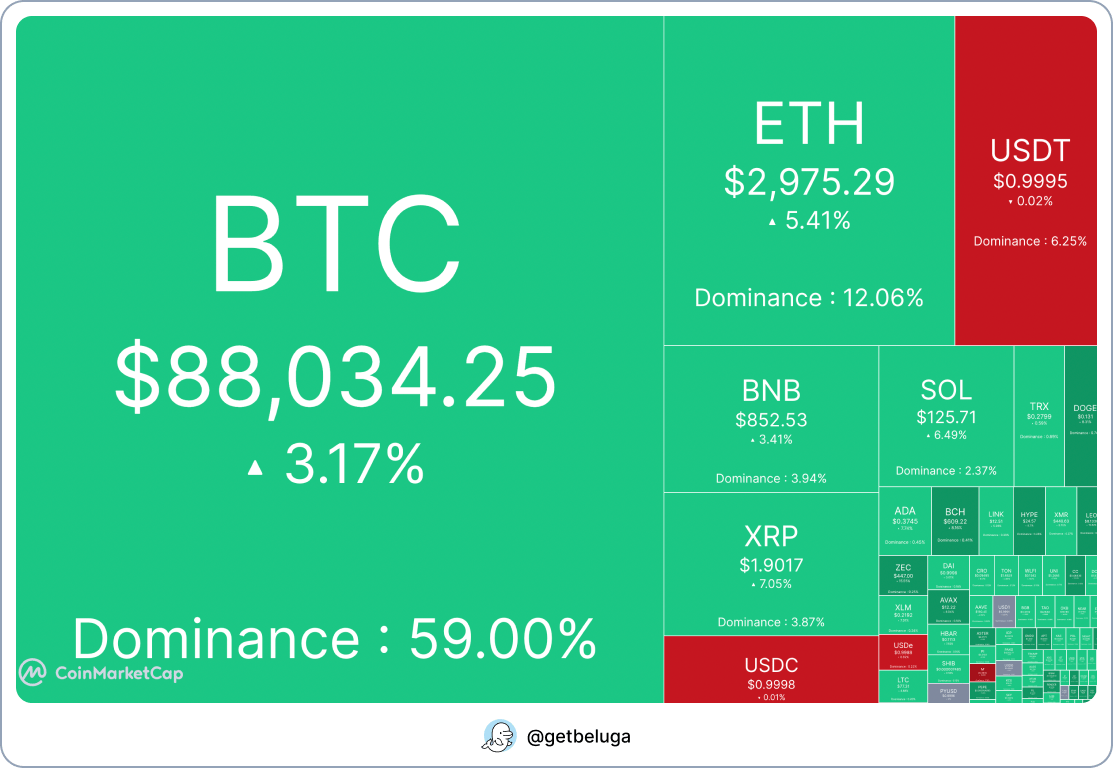

Bitcoin looks to end the week near the $90k level as ETH also bounced back to $3k from lows of $2.8k, marking yet another pretty volatile week for the crypto markets. From where I’m standing, there’s a perfect storm for low liquidity conditions: broader equity markets are nervous about the Fed’s positioning for 2026, market makers are still recoiling from the events of October 10th, Japan’s rising rates have reignited fears of the yen carry trade unwinding, and typical end-of-year rebalancing all come together to create a particularly dangerous market for traders. In addition, while we were hopeful that the new administration could push a crypto market structure bill through, the Senate Banking Committee confirmed this week that it will not hold more hearings on the CLARITY Act before 2026. The House already passed its version of the bill in July with strong bipartisan support, but the Senate being filled with voices like Elizabeth Warren hasn’t helped things move very quickly.

24 Hour Heatmap, Source: CoinMarketCap

It’s not all bad though, as institutional adoption has accelerated at a pace few predicted was possible, led on by the frenzy in the ETFs which now hold $175B in crypto assets. In fact, these products have seen such high demand that BlackRock’s iShares Bitcoin ETF (IBIT) is officially the most successful ETP launch in history. a16z reports in their State of Crypto 2025 that stablecoins hit $46 trillion in transaction volume this year, though they clarify that when filtering out bots or other artificial increases, it is closer to $9 trillion. Even at $9 trillion, this figure is still about half of what Visa processes every year… quite a feat for an industry that was only very recently seen as legitimate. Even if price action over the last couple months doesn’t reflect it, crypto is more integrated into the global financial system than it’s ever been.

Our trading wallet remains unchanged this week (big surprise, I know), and I don’t expect to make many moves before the market figures out which direction it wants to go. At the moment we’re anchored in the majors (BTC and ETH), with healthy allocations in higher-risk altcoins that cover the major narratives I think are primed for growth: DeFi, Stablecoins, RWAs, and Layer 2 infrastructure. The last one named is definitely the most contentious, but if I’m right about Ethereum’s ecosystem claiming the crown over all L1’s, there will be significant value accrual to the right L2’s.

Beluga is excited to offer a new Starter Pack from our partners at DataHaven, a decentralized storage protocol built by industry veterans. Head to the Beluga Starter Pack page to earn an entry into a $1,000 raffle and more!

Refer one subscriber to the Beluga Brief to receive a report on the outlook for crypto in 2026 from Tom Lee’s Fundstrat!