- The Beluga Brief

- Posts

- 🐳 Daily Recap: Market Mellows as BTC Climbs Back

🐳 Daily Recap: Market Mellows as BTC Climbs Back

Are value-accrual tokens like HYPE, SKY the meta in downswings?

Welcome to the Beluga Brief, where we deliver data-driven insights to your inbox every week, spending our time in the crypto trenches and combing through thousands of crypto news feeds so you don’t have to.

As the Beluga Brief grows we’ll try out new content sections and schedules to find what is best for our readers — if you have other suggestions for things you’d like us to cover, feel free to leave a reply on our Twitter!

What happened today?

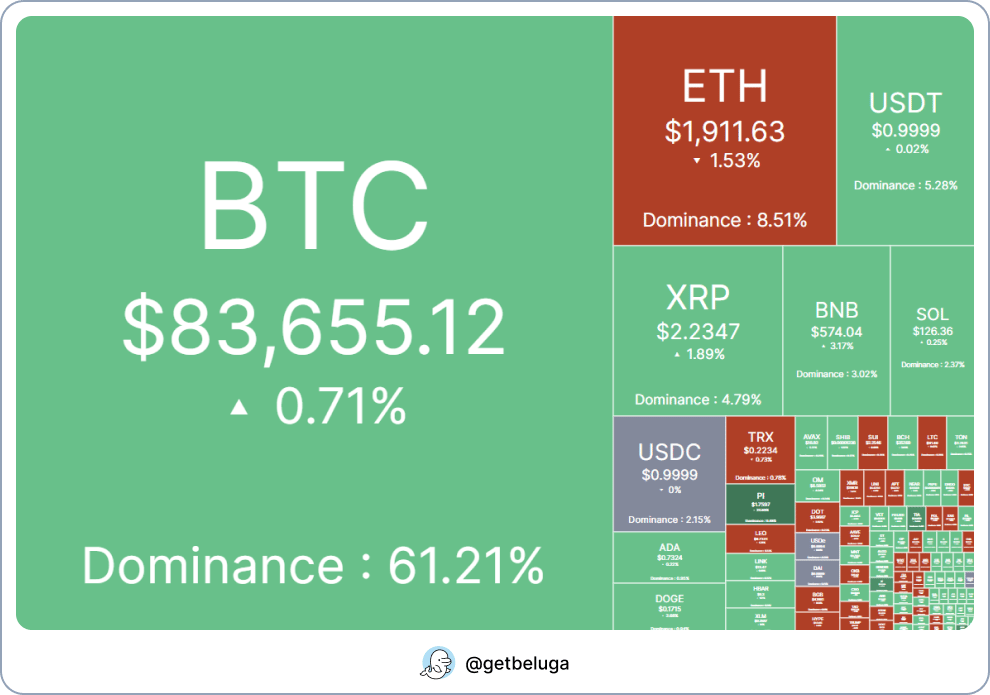

Since the massive plunge to start the week off, sentiment seems to have settled down with Bitcoin recovering above $83,000 at time of writing. According to CoinMarketCap’s Fear and Greed Index, however, the sentiment score is still at its lowest point in a year and a half — last time it was this low, BTC was trading at $40,000.

24 Hour Crypto Heatmap, Source: CoinMarketCap

Despite the carnage in the market, we’re not seeing a slow down in high-profile launches: yesterday we saw Bubblemaps launch their official coin, today Bitcoin Layer 2 Hemi launched their mainnet, Move finally launched their mainnet, and Monad is still expected to be coming soon.* The point is, these teams clearly don’t think this down period is going to last and are still opting to launch in these conditions.

Trading Talk

Something to note when traders are this beat down is that catalysts that would have pumped prices only a few months ago no longer work. In the last 2 weeks, we’ve seen a sitting US Senator propose a bill for the Government to buy BTC, Trump held a meeting with industry leaders to discuss digital assets, and the SEC has dropped a number of cases that it has been pursuing for years. Any individual one of these should be a strong catalyst for buy pressure, but instead BTC has lost 15% in the last 2 weeks. The unfortunate reality is that a significant chunk of the valuation within crypto is due to speculative value, rather than hard value. You actually may be surprised how little the success of the average crypto business has to do with the price action of the underlying token, which leads to bubble-like price action when the broader macro environment becomes more uncertain.

HyperLiquid Performance Relative to BTC, SOL, ETH, Source: TreeNews

There are obvious outliers to this, however businesses that accrue value back to the token are few and far between. Perhaps the most successful of these has been MakerDAO (now rebranded to Sky), but recently HyperLiquid re-popularized the model, albeit in a more “crypto native” way. The team behind HyperLiquid has a perpetual TWAP running on the HYPE token drawing from platform revenues, and I believe from both a hard numbers standpoint as well as a holder/buyer psychology standpoint that it was a significant reason HYPE was able to outperform for so long. Especially in times like this where speculative valuations get eviscerated, it’s important to look for those tokens which accrue real value back to the people holding it.

Tweet of the Day

Hayden Davis cashed out another $700K from $LIBRA and all those scams.

Today, Kelsier dumped some $SOL, sent USDT to Circle and got dollars.

I don’t care if I’m the only one still talking about this.

I’ll keep posting because there’s no way they get away with zero consequences

— dethective (@dethective)

2:29 AM • Mar 11, 2025

Biggest Headlines

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

Regulatory

Miscellaneous

Recent Beluga Content

Just launched: The Hemi Ecosystem Page!

Our team of crypto whales dives deep into the research—so you can just surf the gains.🐳

Hemi Mainnet & Token Overview

— Mainnet just launched!

— $440M in TVL!

— $270M of this is in the staking platform!Why Hemi Matters

☑️ Modular… x.com/i/web/status/1…— Beluga (@getbeluga)

5:20 PM • Mar 12, 2025

The content on this site is for informational purposes only and should not be construed as investment advice. While Beluga strives to ensure the accuracy and timeliness of information, there may be discrepancies when comparing our data to that of financial institutions, service providers, or specific product websites. Always consult with a professional before making any financial decisions.

Will McKinnon is the Head of Content for Beluga and has spent every day for many years trading coins. For that reason there are too many to name, however his largest holdings by a significant margin are Ethereum and Bitcoin. NFA DYOR

*Disclaimer: Hemi is a paid partner of Beluga.