- The Beluga Brief

- Posts

- 🐳 Daily Edition: Bitcoin Fails to Hold $90k as Gambling Industry Continues Growing

🐳 Daily Edition: Bitcoin Fails to Hold $90k as Gambling Industry Continues Growing

An insightful article covering the rise in "Financial Mediocrity" is making the rounds on Twitter today, see our take here!

Want to know what Tom Lee’s price targets for Bitcoin and Ethereum in 2026 are? Refer a friend to the Beluga Brief to receive Fundstrat’s exclusive end of year report for free!

Like clockwork, Bitcoin’s surge back to $90k over the weekend lost its energy as US markets opened this morning, with BTC trading at $87k as of market close. For investors sitting in spot bags, this just constitutes a boring market; for perps traders, however, this has been a nightmare. We’ve seen tens of billions worth of positions liquidated over the last 2 months on a market that really hasn’t moved all that much, so it should come as no surprise that volume on Hyperliquid (the largest perps DEX) is on track to have its lowest volume month since November 2024.

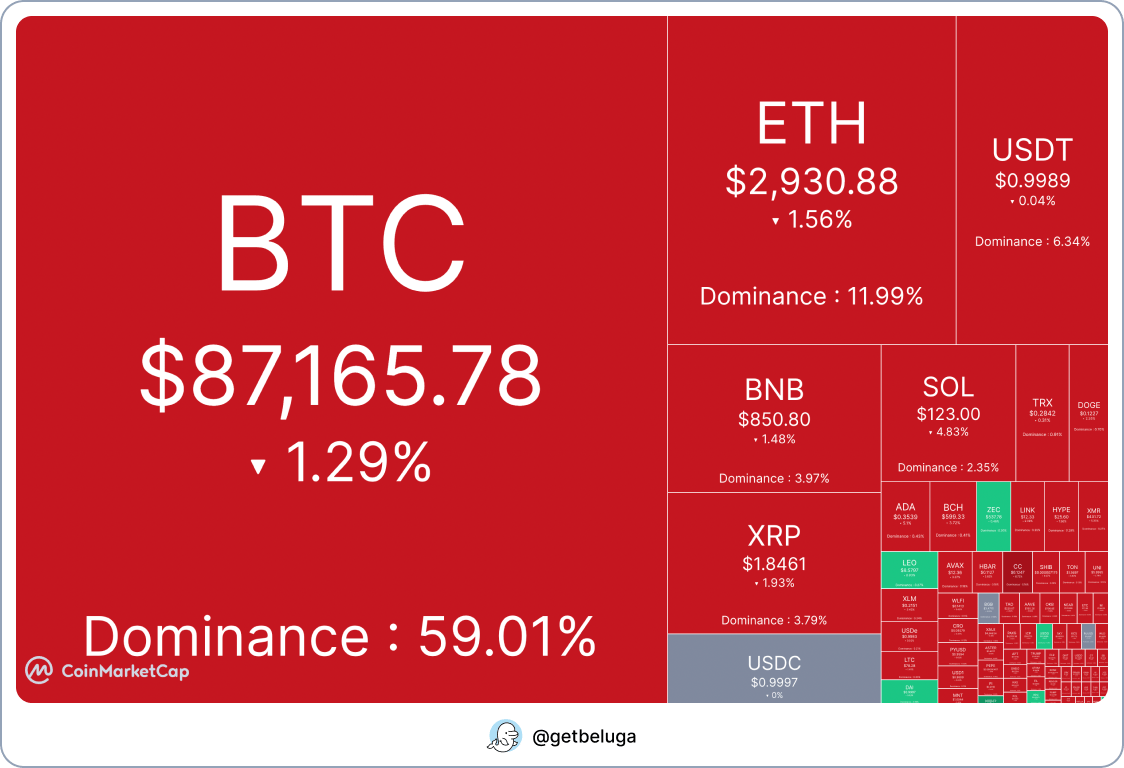

24 Hour Heatmap, Source: CoinMarketCap

Since price action is admittedly boring and most crypto natives I know are disinterested with the market, I wanted to take a second to highlight a great article I came across earlier today that is making the rounds on Twitter. The article, titled “The Prison of Financial Mediocrity”, delves into the concept we’ve discussed somewhat frequently in the Beluga Brief of “Financial Nihilism” and explains the rise in hyper-speculative activities… or in other words, gambling. A few years ago the path to success was already becoming murky, but the advent of AI has made the window of opportunity shrink at an incredible rate. Whereas before there was an inherent promise for bright minds joining the white collar workforce that if they worked long enough they would eventually be able to “make it”, now we are realizing that most of these departments likely won’t even exist in the near future. Combine this with social media showing everyone that the grass is greener on their side of the yard, and you’ll start to see why the younger generations are getting desperate.

Rather than wallow in self-pity, I believe this is actually an opportunity for those who wish to see it that way. In a world pushing us to take on more risk for a shot at the good life, the entities that provide those shots (Trading apps, blockchains, sports books, etc) could prove to be some of the most asymmetric bets we can possibly make. To paraphrase the old adage, we want to sell the picks and shovels, not buy them. The talking heads on Crypto Twitter will tell you to just keep clicking; I’m here to tell you to be a bit more patient, and spend your time trying to predict where the next wave of degeneracy will be flowing. If there’s one thing I know for certain, it’s that the next wave will come, and I want to be positioned in the best place possible to capture it.

The Beluga intern has been hard at work gathering all the most important crypto news stories so you have them in one place!

The Majors

Alt Coins and Stocks

Interesting Reads

Check out our new articles below!