- The Beluga Brief

- Posts

- 🐳 Weekly Edition: Ethereum ETF's Break Records as Trump Signs GENIUS Bill

🐳 Weekly Edition: Ethereum ETF's Break Records as Trump Signs GENIUS Bill

Weekly flows for Ethereum ETF's near $2 Billion as the first framework for stablecoins is signed into law

Ethereum has dominated headlines this week, now trading at $3,550 after dipping under $1,400 just a few months ago. Back then, claiming ETH would be the de facto layer for tokenized assets would have earned you a series of insults on Twitter; today, you’d see the heads of the largest institutions in the world agreeing with you. This is not to say that the entire move has been caused by this narrative shift, as we all know that price tends to lead narrative in this industry, but it has certainly made an impact. The market’s renewed interest in ETH has led to not one but two consecutive record-breaking days for the Ethereum ETFs with almost $2B in capital added this week, and $700M on Wednesday alone. A major piece of this recent price action is of course the success and proliferation of Ethereum Treasury Companies (companies that allocate treasury funds towards buying Ethereum) like Joe Lubin’s Sharplink Gaming or Tom Lee’s Bitmine — this class of companies is highly reflexive, and the idea will only become more popular as the price rises.

Joe Lubin, CEO of Consensys and Chairman of Sharplink Gaming

Today also marked a historic moment for crypto, with President Trump signing the GENIUS bill into law which entails a framework for the creation and usage of stablecoins pegged to the US dollar. While I won’t sit here and tell you these rules matter much for the average crypto trader, proper regulation is something our industry desperately needs and this is a meaningful step in the right direction. It will also (in theory) help to prevent stablecoin-related disasters like we saw with the collapse of Terra Luna last cycle. On the slightly more “grey area” side of Trump’s crypto dealings today, the World Liberty Finance DAO has voted to enable the WLFI token to be tradable. The team estimates trading will go live in 6-8 weeks as it works to secure partnerships and other parts of the product before then. Whichever way the token goes, it’s certain to cause a splash and we’re excited to watch it unfold.

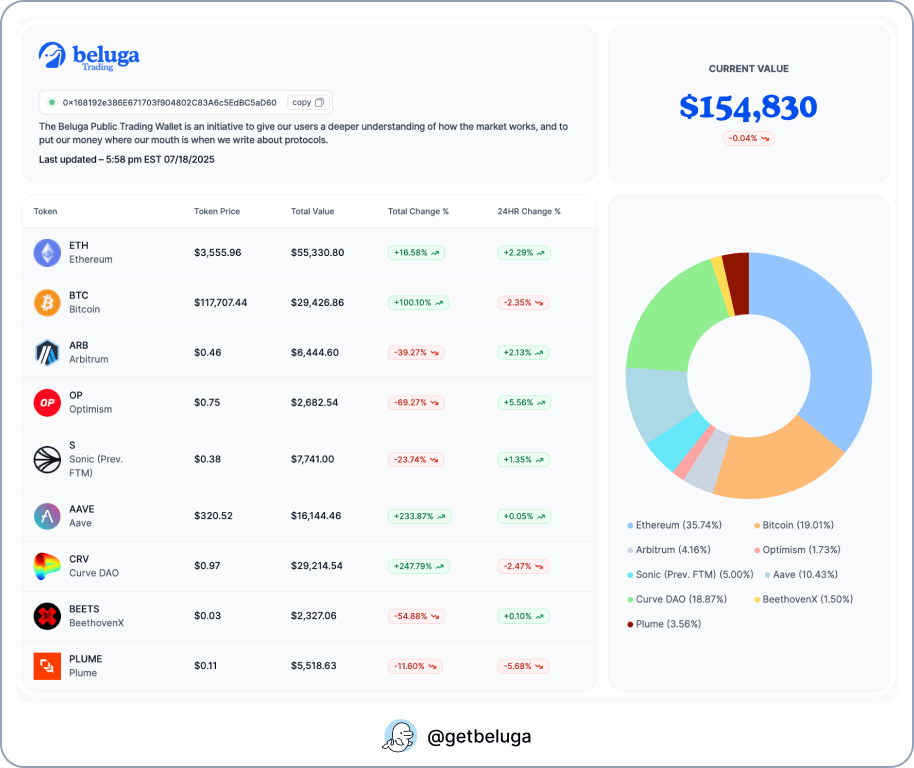

The Beluga Trading Wallet sits about $17,000 higher than our update last Friday, mostly driven by the crazy pump on ETH this week. It certainly hasn’t been the easiest coin to hold, but I believe the payoff will be worth it — the target for this cycle remains $10,000. Assuming this ETH move continues, we’ll be looking for liquidity to flow into alt-coins next. The tokenization of RWA’s and DeFi as a whole should be major beneficiaries of increased attention on the Ethereum ecosystem, so that’s where we’ve concentrated our bets for now.

Why waste your time in class when you can raise hundreds of millions to buy Bitcoin and Ethereum instead?

There is basically no reason for a young person to get a college degree anymore. Between the internet and ChatGPT you have basically every bit of knowledge you need to launch a crypto treasury company

— Gwart (@GwartyGwart)

1:17 PM • Jul 18, 2025

As the ink dries on the GENIUS bill....

🚨 Heads up: @worldlibertyfi WLFI has been approved for trading.

— Launch expected in 6–8 weeks.

— Full rollout details dropping soon.

— Stay sharp, this one could move fast.Check our Top 50 List for more:

heybeluga.com/hottest-token-…— Beluga (@getbeluga)

7:10 PM • Jul 18, 2025